Quicken Demo For Mac

Quicken 2015 for Mac is a misleading update of the generally loathed Quicken Essentials for Mac. Quicken 2007 for Mac, which works in Snow Leopard through Yosemite (and probably in El Capitan) and is available for $15 from Intuit, supports amortizations. Quicken Starter 2019 Personal Finance Software 1-Year + 2. Quicken 2019 for Mac imports data from Quicken for Windows 2010 or newer, Quicken for Mac 2015 or newer. The first is completely free and the other has a free 30-day trial.

Quicken is the granddaddy of, and it’s the product users love to hate. I’ve been a Quicken user since 1992 — now over 26 years.

I used to track every one of my 60-plus accounts with Quicken. I had every bank account, credit card, asset, retirement, investment and liability linked to the software. So to say I’m a power-user of this product would be an understatement.

In case you missed it, Quicken is no longer owned by Inuit, which. Long term, I’m not sure what to make of this news or what it means for the future of Quicken. However, in the two years since the sales, there have been a number of improvements made to Quicken. At one time, this software was the only game in town. Today, that is no longer the case, and you have many to choose from.

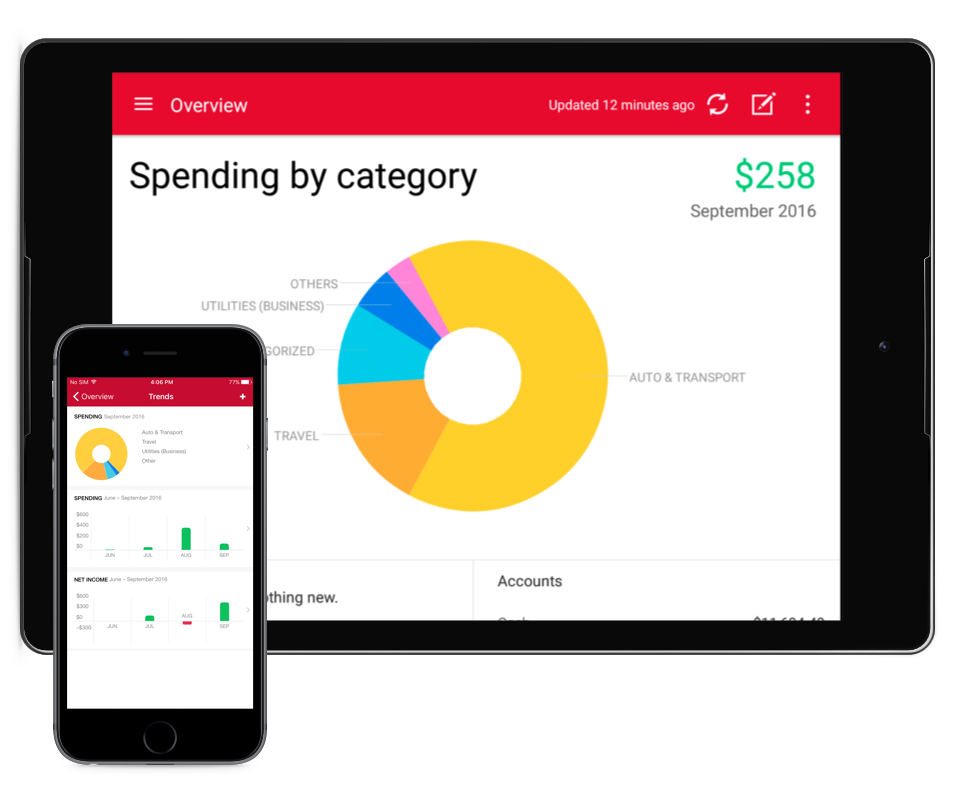

Today, it’s possible to store your financial information completely online using services like, which we recommend as the best personal finance service,. However, these financial aggregation services tend to be read-only and are better suited for alerts or reporting your finances.

Where is mac iso stored for sierra. All the security updates etc installed from the image inside as well so the current version is 10.12.6. However, when I tried to upgrade to 10.13 all went well and no error messages etc appeared BUT the system rebooted into the existing 10.12 version What went wrong under the hood and what do I have to tweak to get it into booting the new system??

Reconciliation and online bill pay aren’t available with these types of services. To be fair, most banks offer online bill pay via their websites or mobile apps, so the need for online bill pay with your personal finance software has waned. For individuals who prefer to stay with a locally installed program, there’s.

Or if you’re looking for a native Macintosh software application, there’s, as well. But none of these applications come close to Quicken in terms of market share or the comprehensive personal finance features that still make Quicken for Windows the industry leader. So that brings us to reviewing the latest version of Quicken. Quicken for Windows Features. Testing Quicken 2019 For this review, Quicken supplied a copy of Quicken Premier 2019 for Windows, and I converted from my previous test installation of Quicken 2018. This test was conducted over a two-week period and used most parts of the application.

To be fully transparent to our readers, I no longer use Quicken on a daily basis and have. So with Quicken 2019, I imported what I could from the old version but also set up new accounts missing from the previous testing. I specifically tested all accounts that had online synchronization, since that appears to be a common problem area among Quicken users. Now an Annual Subscription Last year, Quicken 2018 made headlines by going subscription-only. Before, you had up to three years to use the software. However, now you must subscribe and pay on an annual basis.