Print 1099 In Quickbooks For Mac

• Did you pay a 1099 contractor for a service or work done in Wisconsin? • Did you pay the contractor $600 or more for this work or service? The state of Wisconsin requires that boxes 16 and 17 are completed on Form 1099-MISC. You may be charged $10 for each 1099 form that is missing information in boxes 16 and 17. Here's how to be compliant. If you withheld any Wisconsin state income tax from a payment you made to your contractor or vendor, you are required to have a Wisconsin withholding ID. • Your ID should be the abbreviation for Wisconsin (WI) and your 15 digit WI withholding ID - Example: WI 99999 • If you did not withhold state income tax and do not have any other requirement to have a Wisconsin withholding ID, then enter WI 88801 For more information, please contact the.

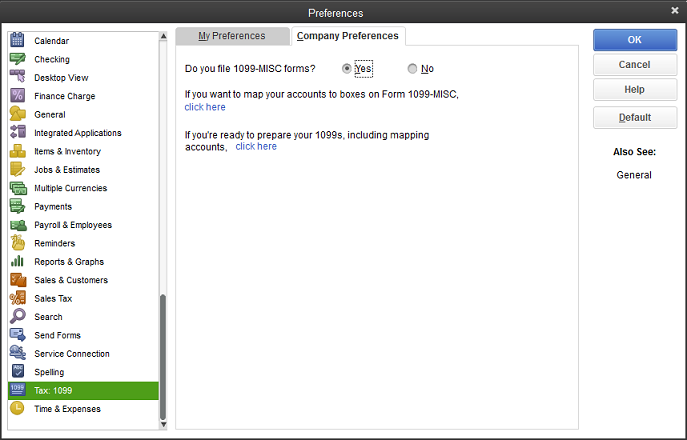

You will need to map your expense accounts in QuickBooks for 1099 preparation. • Go to the Edit menu and select Preferences.

Oct 25, 2018 - This article provides alignment instructions for 1099 forms. PDF files in the default PDF viewer application.

• Select Tax:1099 from the right pane. • Then, select Company Preferences tab. • Select Yes when prompted with whether you want to file 1099-MISC forms. • Map your chart of accounts to the different line items on the 1099-MISC. Example: You can select the account in the drop-down box for Box 1: Rents. If you only have one account for this where you book all your rental expenses, you would then select that account from the chart of account. Practical consideration: When selecting this for, you will probably need to map multiple accounts. Word for mac sending merge html email duplicate pictures.

• Select Multiple Accounts in the drop-down menu. • Go to the appropriate account, such as legal, accounting, consulting, or so on • Set your filing thresholds according to the IRS instructions. • Click OK to save your work.

Practical consideration: You should visit for instructions on preparing and filing the 1099-MISC forms if you are not familiar with this process. Now that have successfully mapped your accounts, QuickBooks will automatically be able to select which vendors need 1099-MISC forms based on which account you book their expenses to and the threshold you entered.

Mac driver for belkin f5d9050. If your driver is not listed and you know the model name or number of your Belkin device, you can use it to for your Belkin device model. After you complete your download, move on to.

You should still review which vendors will receive 1099-MISC forms to ensure that you are including all vendors. To review the vendors for which QuickBooks will send a • Go to the Vendors menu and select Print/E-file 1099s. Click on the box under 1.

Review your 1099 vendors. • A list of all vendors will be displayed with a column that shows if they are marked “yes” or “no” for receiving a 1099. • Review this list to make sure all your vendors are accurately included or excluded from receiving a 1099-MISC. • To change a specific vendor, just double-click on the vendor from this report. • Click on the Additional Info tab and select (or unselect) the checkbox for Vendor eligible for 1099. • Once you are satisfied with your changes to close the list and return to the 1099 and 1096 Wizard screen.

Review the report that shows all vendors that are marked for a 1099 with their current year information for each type (or Box) of income to be reported on the 1099-MISC for accuracy. • From the 1099 and 1096 Wizard screen, click on the box under 3. Review your 1099 data. • Review this report for accuracy. Practical consideration: You should pay special attention to the Uncategorized column -- any amount in this column has been placed in an account that was not mapped. Practical consideration: You should check to make sure that each recipient has a tax ID number associated with it.